No. 208 – How to work out your retirement savings number

Question

My friends tell me that I need R30 million in order to retire. My savings are nowhere near that. Am I in trouble?

Answer

The amount of money that you need in order to retire will depend on how much you need to live on when you have retired.

I do a lot of retirement counselling with individuals approaching retirement and determining how much they need to live on is always the first step in the planning process. I’ve found that this amount can vary dramatically — from as little as R8,000 to as much as R230,000 per month.

Now, depending on how much you need in a month, the amount of retirement capital that you need will vary. If you need an after tax income of R100 000 a month, you will need around R32m in savings. I suspect that this is where the R30m story comes in. However, I find most retired people that I help need an after tax income between R30 000 and R50 000 a month.

I will go through the factors you need to consider when working out how much you will need in order to retire:

Monthly Budget

The first step in working out how much you need when you retire is to get an idea of how much you need to live on each month.

I would recommend that you draw up a budget based on what you are currently spending and then amend it to reflect the type of spending pattern you may have when you retire. For example, your parking and lunchtime costs will probably reduce while your medical costs will increase. If you need help here, I have a retirement budget spreadsheet that I’m happy to e-mail to you.

Tax

Once you have figured out how much you need, you need to increase that amount with a factor that accounts for income tax. I have seen many people forget about this crucial element when they do their retirement plans and then suddenly find that they are underfunded.

Drawdown rate and investment strategy

You need to ensure that you will have enough money to live on until you, your spouse and any dependents pass away.

As one in ten of us are likely to live to 100, you need to plan on having enough capital for the next 35 years when you retire. What is more, this capital needs to be invested in such a way that it can withstand all the economic and political challenges that you are going to experience over the next 35 years.

For someone who is retiring at the age of 65, just think back to what the world was like when you were 30 and all the political and economic challenges that you had to deal with. When you retire, you will have to meet a similar set of challenges but will only have your retirement capital to depend on. There will be no promotions or performance bonuses to help you. It is therefore vital that you get the right investment strategy in place.

The recommended drawdown rate for a 65 year old is 5%. The thinking here is that the typical costs of a living annuity come to around 2.5% so as long as your investments are growing by more than 7.5%, your pension will increase each year and be sustainable for the rest of your life.

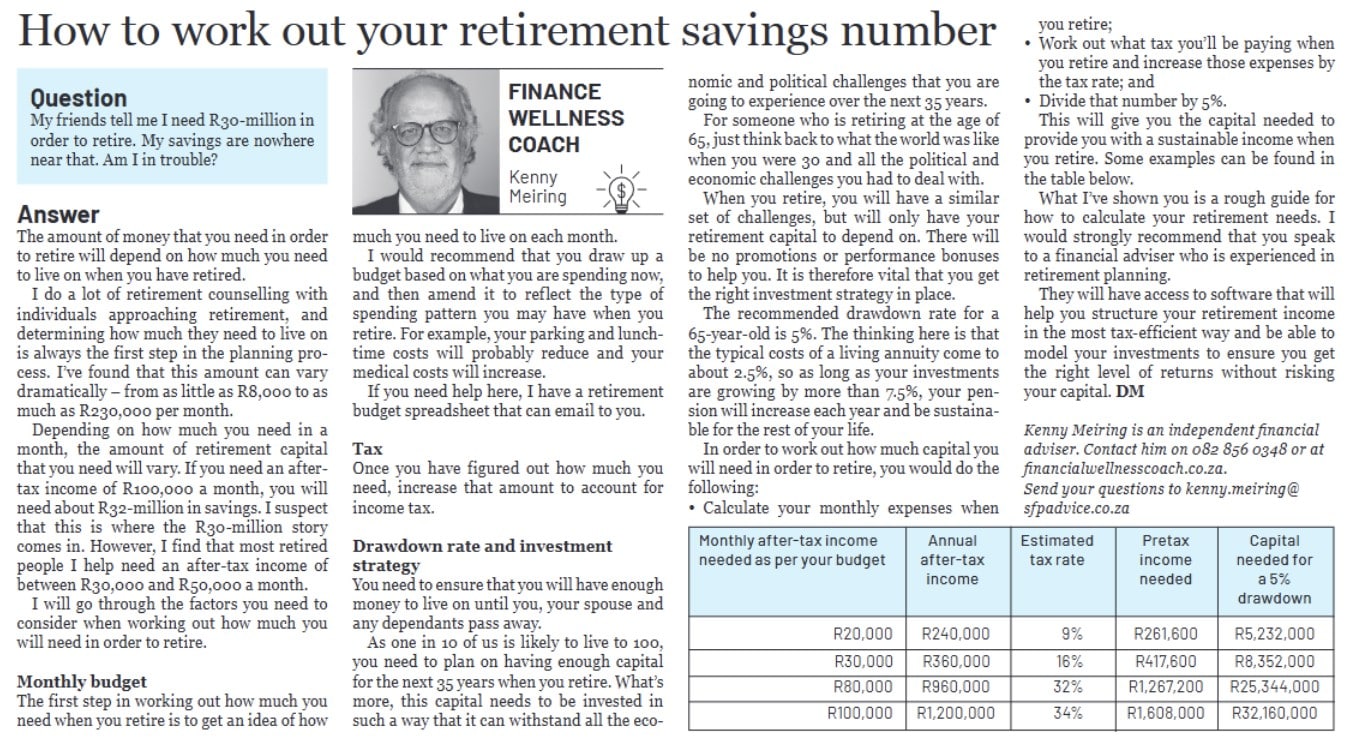

In order to work out how much capital you will need in order to retire, you would do the following

- calculate your monthly expenses when you retire

- work out what tax you’ll be paying when you retire and increase those expenses by the tax rate

- divide that number by 5%

This will give you the capital needed to provide a sustainable income when you retire.

Here are some examples:

|

Monthly after-tax income needed as per your budget |

Annual after-tax income |

Estimated tax rate |

Pretax income needed |

Capital needed for a 5% drawdown |

|

R20,000 |

R240,000 |

9% |

R261,600 |

R5,232,000 |

|

R30,000 |

R360,000 |

16% |

R417,600 |

R8,352,000 |

|

R80,000 |

R960,000 |

32% |

R1,267,200 |

R25,344,000 |

|

R100,000 |

R1,200,000 |

34% |

R1,608,000 |

R32,160,000 |

What I’ve shown you is a rough guide on how to calculate your retirement needs. I would strongly recommend that you speak to a financial advisor who is experienced in retirement planning.

You are making some extremely important decisions That will affect the next 35 years of your life. Your advisor would have access to software that will help you structure your retirement income in the most tax efficient way and be able to model your investments to ensure that you get the right level of returns without risking your capital.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!