No. 073 – Why it’s a good idea to have 40% of assets invested offshore

Question

I invested some money offshore last year and saw that it has declined by 8%. Should I cash it in and put the money back in the bank?

Answer

Before you cash in your offshore investment, you should ask yourself why you invested offshore in the first place.

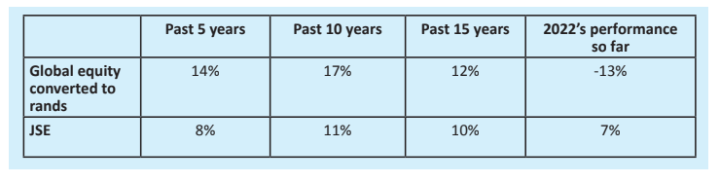

I recommend to most of my clients that they have between 40% and 60% of their assets offshore. My reasoning is that it makes good financial sense not to have all your eggs in one basket. You can reduce your overall investment risk by spreading your investments across a number of countries. There are just over 400 shares that you can invest in on the JSE, a few of which are really big. If you look beyond our borders, there are more than 40,000 shares that you can invest in. Offshore investments have done particularly well in the past, as can be seen in the table below.

If you look at the performance of offshore so far this year, you can see the impact of the inflation in the US and the war in Europe.

The question you need to ask is whether the pros of offshore investing (by having additional diversity and the long-term track record) outweigh the short-term issues?

Are you trying to time the market?

Do you think that the market is going to continue falling and that you can buy back into it at a lower price?

If that is the case, I would strongly caution against doing so as it is very difficult to time the market. Large, upward market movements often come soon after a market fall.

I used the following example to caution my clients from cashing in their investments when the markets fell in 2020 because of Covid-19 (they bounced back by about 40%).

Example

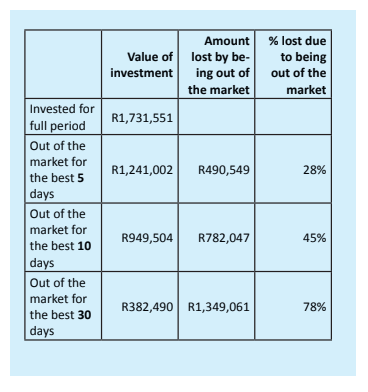

If you invested R100,000 in the JSE All Share Index at the end of February 1997, by the end of 2019, it would have been worth just more than R1.7-million.

If you were out of the market for just a few days when the market moved, however, your result would have be very different. The table below shows how missing key growth days affected the outcome.

Time in the market usually trumps timing the market.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!