No. 223 – Time plus compound interest equals big returns

Question

I’m a 74-year-old ‘financially illiterate’ gran learning so much from your column. I have a newborn grandson and would like to start some sort of ‘fund’ for his future. What would you advise?

Answer

The single most powerful advantage a newborn has over the rest of us is time. If you combine time with a tax friendly investment, you can turn small monthly amounts into life-changing sums by the time he’s an adult.

There are a number of options open to you. The choices you make will be determined but how much you have available to invest as well as your timeframe for your grandson to access these funds.

You can invest anything from R12,000 a year to R100,000 a year. Beware that if you invest more than R100 000 per tax year, it will trigger donations’ tax of around 20%. This amount is for all your donations, so if you have two grandchildren, you can only donate R50 000 a year to each

There are a couple of options open to you

- Tax-free investment

Any person — including a minor — may hold tax-free investments. A parent or legal guardian opens the investment in the child’s name. That’s good for both clarity and estate planning. Keep two limits in mind: the annual cap is R36 000 and the lifetime cap is R500 000 per person.

The big advantage with a tax free investment is in its name. You don’t pay any tax on the gains in the investment. The longer the investment runs for, the greater the capital gains and the more CGT you will be saving. You should therefore only use this tax free investment option for a long term investment.

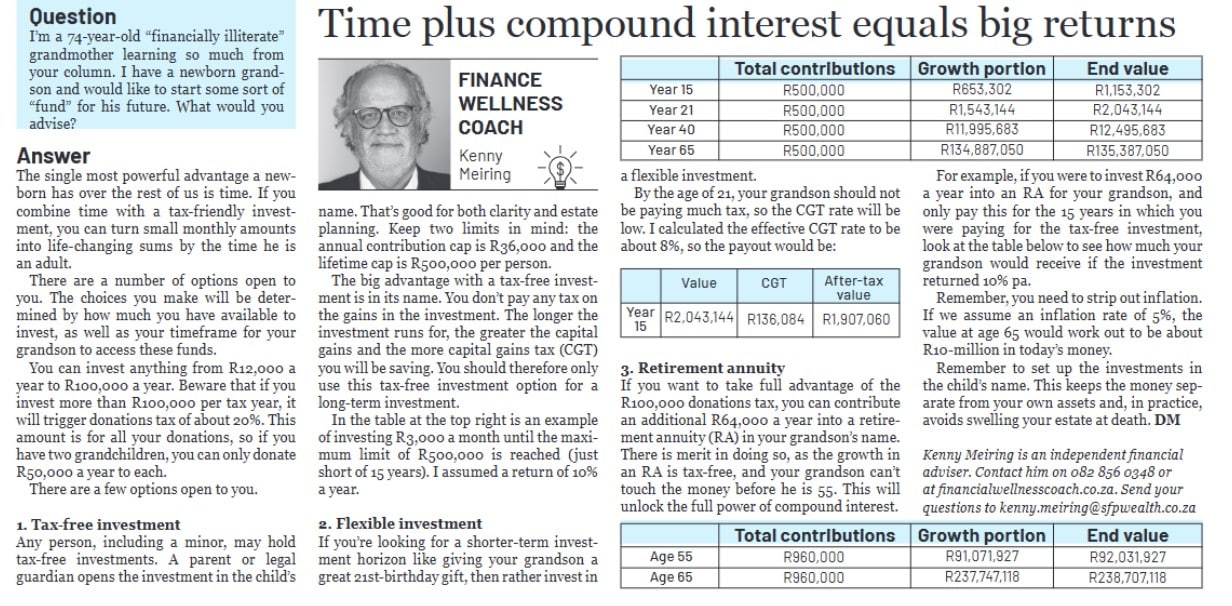

Here is an example of investing R3 000 a month until the maximum limit of R500 000 is reached (just short of 15 years). I assumed a return of 10% a year

|

|

Total Contributions |

Growth Portion |

End Value |

|

Year 15 |

R500,000 |

R653,302 |

R1,153,302 |

|

Year 21 |

R500,000 |

R1,543,144 |

R2,043,144 |

|

Year 40 |

R500,000 |

R11,995,683 |

R12,495,683 |

|

Year 65 |

R500,000 |

R134,887,050 |

R135,387,050 |

- Flexible investment

If you’re looking for a shorter term investment horizon like giving your grandson a great 21st birthday gift, then rather invest in a flexible investment.

By the age of 21, your grandson should not be paying much tax so the CGT rate will be low. I calculated the effective CGT rate to be around 8% so payout would be

|

|

Value |

CGT |

After tax Value |

|

Year 15 |

R2,043,144 |

R136 084 |

R1 907 060 |

- Retirement Annuity

If you want to make full advantage of the R100,000 donations tax, you can contribute an additional R64,000 a year into a retirement annuity in your grandson’s name.

While this sounds like a bizarre idea, there is merit in doing so as the growth inside the retirement annuity is tax free. In addition to this, your grandson cannot touch the money before he is 55. This will unlock the full power of compound interest – 55 years of tax free growth will result in an impressive payday.

So, for example, if you were to invest R64,000 a year into a retirement annuity for your grandson, and only pay this for the 15 years in which you were paying for the tax free investment, your grandson would have the following if the investment returned 10% pa:

|

|

Total Contributions |

Growth Portion |

Value |

|

Age 55 |

R960,000 |

R91,071,927 |

R92,031,927 |

|

Age 65 |

R960,000 |

R237,747,118 |

R238,707,118 |

Now, before you get distracted by the telephone numbers in the end value, you need to strip out inflation. If we assume an inflation rate of 5%, then the value at age 65 would work out to be around R10 million in today’s money. Now that is more than most people have in their retirement funds when they retire after working for a company their entire lives.

Let that sink in – your gift will probably be worth more than their pension fund when they retire after working for 45 years.

Remember to set up the investments in the child’s name. This keeps the money separate from your own assets and, in practice, avoids swelling your estate at death. This is cleaner than “earmarking” an account in your name.

By taking advantage of clever tax structures and the power of compound interest, you can make a significant financial difference in your grandson’s life.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!