No. 220 – How to strike the right balance between caution and growth

Question

With inflation now around 3%, the Reserve Bank cut rates by 0.25%. That’s great for borrowers, but I’m a 68-year-old pensioner living off the interest from a 32-day call account. I know it’s not ideal — no growth and I’m just spending the interest. I have R5 million. Can I do better without taking big risks?

Answer

A call account is safe, but three things will hurt you over time

- Your income will reduce as rates fall. Since last year you would have experienced 5 interest rate cuts and as a result, your income will have reduced.

- Inflation will hurt your buying power over time. If you are living off the interest from the investment, the capital amount that you invested will buy you a lot less in the future than it will now.

- Bank deposits are not the most tax efficient of investments. You are taxed on all the interest (after your initial interest exclusion) that the bank deposits generates regardless of whether you are drawing it all out as an income.

A solution that I like to use as an alternative to bank deposits is a low-risk flexible investment portfolio. This aims at helping your money grow at an inflation beating rate, keeping the tax that you pay to the minimum and protecting your savings from too much risk.

There are two elements to this portfolio:

- An income fund

These are a lot like the bank deposits and are invested in low risk structures like money market funds and bonds. These typically target a return of CPI + 2%. As the interest element of these investments will be taxable, we do not put everything into this portfolio. This is where the second part of the portfolio is used

- A low-risk hedge fund

A low-risk hedge fund realises most of its return in the form of capital gains rather than interest. As a result, you will end up paying a lot less tax on your income.

You need to ensure that you are in a low risk hedge fund. So, ask your financial advisor to confirm the Value at Risk (VAR). If the VAR is 5%, it means that there is a 99% chance that you will not lose more than 5% of your investment in a month.

Do not be alarmed when you see the management fees on the hedge funds. These are a lot higher than normal investments. Rather, look at what the returns have been in the past. These returns are the returns after the investment management fees have been taken off.

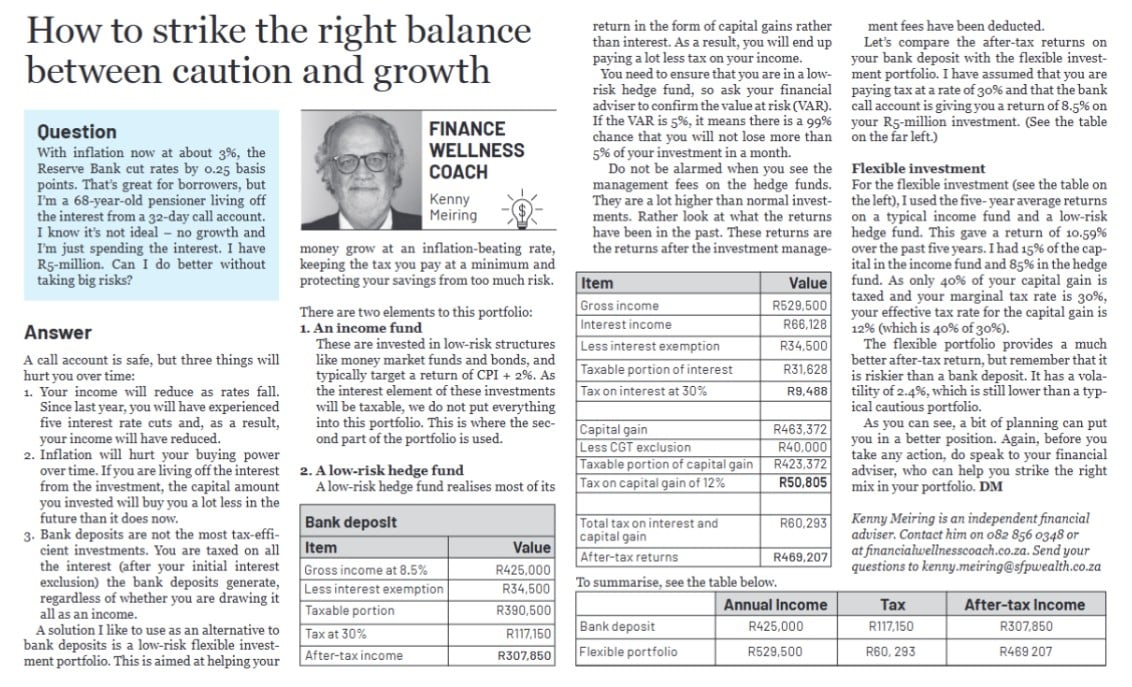

Let’s compare the after- tax returns on your bank deposit with the flexible investment portfolio. I have assumed that you are paying tax at a rate of 30% and that the bank call account is giving you a return of 8.5% on your R5 million investment

Bank deposit:

|

Item |

Value |

|

Gross income at 8.5% |

R425 000 |

|

Less interest exemption |

R34 500 |

|

Taxable portion |

R390 500 |

|

Tax @ 30% |

R117 150 |

|

After tax income |

R307 850 |

Flexible investment

For the flexible investment, I used the 5 year average returns on a typical income fund and a low risk hedge fund. This gave a return of 10.59% over the past 5 years. I had 15% of the capital in the income fund and 85% in the hedge fund. As only 40% of your capital gain is taxed and your marginal tax rate is 30%, your effective tax rate for the capital gain is 12% (which is 40% of 30%)

|

Item |

Value |

|

Gross income |

R529,500 |

|

Interest income |

R66,128 |

|

Less interest exemption |

R34,500 |

|

Taxable portion of interest |

R31,628 |

|

Tax on interest at 30% |

R9,488 |

|

|

|

|

Capital Gain |

R463,372 |

|

Less CGT exclusion |

R40,000 |

|

Taxable portion of capital gain |

R423,372 |

|

Tax on capital gain of 12% |

R50,805 |

|

|

|

|

Total tax on interest and capital gain |

R60,293 |

|

After tax returns |

R469,207 |

To sumarise we have

|

|

Annual income |

Tax |

After tax income |

|

Bank deposit |

R425,000 |

R117,150 |

R307,850 |

|

Flexible portfolio |

R529,500 |

R60, 293 |

R469 207 |

The flexible portfolio provides a much better after-tax return, but remember it is riskier than a bank deposit. It has a volatility of 2.4%, which is still lower than a typical cautious portfolio.

As you can see, a bit of planning can put you in a better position — increasing your income significantly without taking on too much risk. Again, before you take any action, please speak to your financial advisor who can help you strike the right mix within your portfolio.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!