No. 206 – Whether to keep or cancel a life insurance policy

Question

I took out a life insurance policy many years ago which will pay out about R20m. I do not need the life cover anymore as the loan it needed to cover has been settled. The current premiums are about R35k a month and the premiums increase by 6% a year. I am 70 years old and in good health.

The question is, is it prudent to keep the policy or to terminate it?

Answer

The issue of keeping or cancelling life insurance policies is a relevant one for many people. The premiums often increase by more than one’s income does and they start to use up more and more of the available family budget. The question is whether you will be helping or harming the family’s financial health by cancelling it. I will take you through my thought process when it comes to answering this question.

We typically take out life insurance to cover a particular risk. These would include covering a debt or protecting the family income.

If the debt has been repaid or you have reached the stage in life where you are living off your capital, is there still a need to carry on the paying the premiums on the life insurance? If you invested these premiums, at what stage would you be better off?

As we don’t know when we are going to pass away, there is no definite answer that I can give. You can, however, do a calculation to determine at what age the value of this investing the premiums is likely to exceed the sum assured should you pass away

There are, however, a couple of factors that you must be aware of:

Type of life policy

Not all life policies are the same. Many of the older policies combined investment and risk benefits. When you cancelled the policy, you would get a cash payout. This cancellation payout often increased the longer you kept the policy.

These were subsequently replaced by policies that provided just risk cover so when you cancelled the policy there would be no cash payout. I like these as it is very easy to make a decision as to whether it is worth keeping the policy

The current trend amongst life insurers is to try and encourage you to keep the policies for longer by adding in complicated bonus structures that pay out bonuses or premium refunds at certain stages in the future. This does muddy the waters but it is relatively easy to calculate the true value of this benefit.

Annual increases in cover

Is the life cover increasing, decreasing or remaining the same each year? If so, what is the size of this increase?

Annual increases in premium

Are the premiums increasing each year? If so, what is the size of this increase?

In many instances, these increases are a fixed percentage so the calculation would be quite simple. You do however you have life insurance that increases by an age rated factor and the premium increase gets larger each year. What I would recommend that you do is take the average increase over the past five years and then apply it into your calculation.

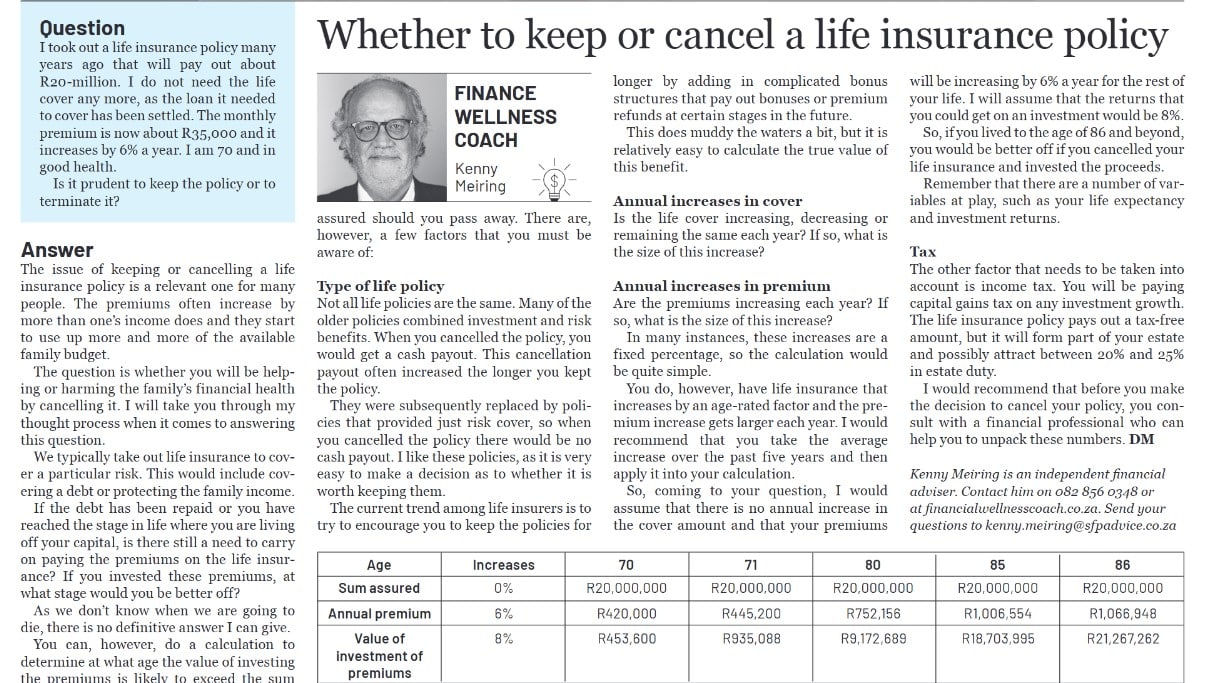

So, coming to your question, I would assume that there is no annual increase in the cover amount and that your premiums will be increasing by 6% a year for the rest of your life. I will assume that the returns that you could get on an investment would be 8%

|

Age |

Increases |

70 |

71 |

80 |

85 |

86 |

|

Sum assured |

0% |

R20,000,000 |

R20,000,000 |

R20,000,000 |

R20,000,000 |

R20,000,000 |

|

Annual Premium |

6% |

R420,000 |

R445,200 |

R752,156 |

R1,006,554 |

R1,066,948 |

|

Value of investment of premiums |

8% |

R453,600 |

R935,088 |

R9,172,689 |

R18,703,995 |

R21,267,262 |

So, if you lived to the age of 86 and beyond you would be better off if you cancelled your life insurance and invested the proceeds.

Remember that there are a number of variables at play like your life expectancy and investment returns.

Tax

The other factor that needs to be taken into account is income tax. You will be paying capital gains tax on any investment growth. The life insurance policy pays off a tax free amount, but it will form part of your estate and possibly attract between 20 and 25% in the state duty.

I would recommend that before you take the decision to cancel your policy, consult with a financial professional who can help you unpack these numbers.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!