No. 039 – Everything you need to know about moving money offshore

Question

I retired three years ago, with half my income coming from my company pension fund and the other half from interest from investments. I am paying tax at a rate of 41%. Is there anything that I can do to reduce this amount?

Answer

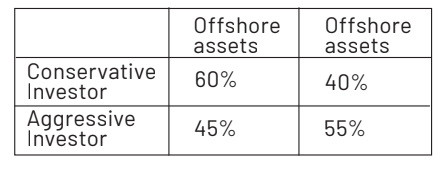

The South African economy accounts for less than 1% of the world’s economy. It is risky putting all your eggs in one basket. I came across this model that I use as a discussion aid with my clients to decide how much they should have offshore.

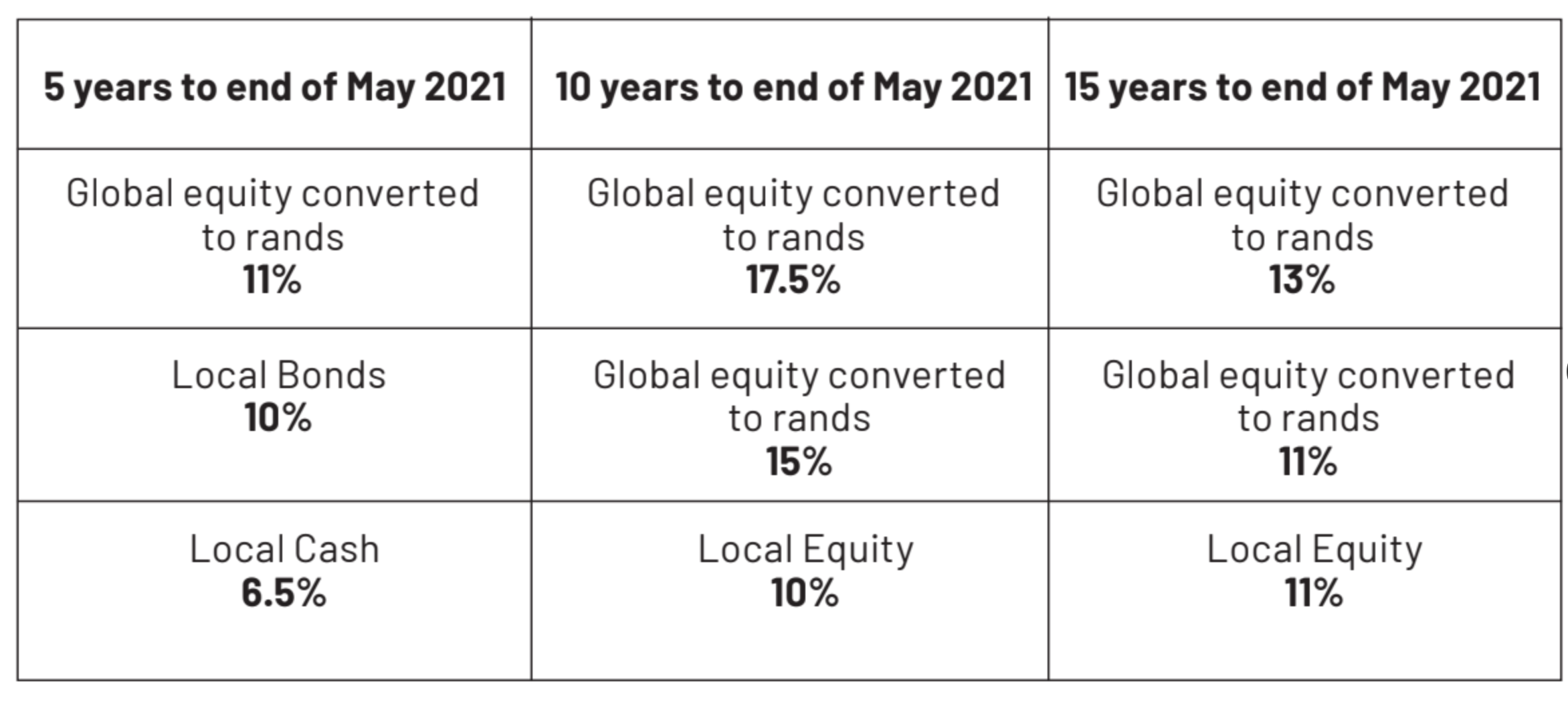

It is relatively easy to move funds offshore – your financial adviser or a forex specialist should be able to facilitate this for you.Most of us will not have travelled much over the past year, so we will all have the annual R1-million available to convert into dollars, pounds or euros. This can be done within a few days. In addition, we are also allowed to move R10-million a year offshore. This takes a little longer to organise but you should be able to have this done within a month.Moving money offshore is one thing, but what should you do with it once it’s there?I have come across so many people who moved money offshore in the 1990s and left it in an overseas bank account, earning very little interest. I shudder to think of the opportunity cost of not having the funds invested in a better structure.If you look at the table below, you will see that global equity was the best-performing asset class over the past five, 10 and 15 years:

It is not enough to move the money offshore; you need to invest it in something that will give you growth.I help a lot of people with their estate planning and there are two issues that I watch out for if they have offshore investments:Situs tax: This is like our estate duty. It is levied by the country in which the asset is located. If, say, you own shares registered on the British or American stock exchanges, these could be liable for a situs tax of up to 40% should you die. There are no spousal estate duty concessions like you have in SA. Your spouse may encounter cash flow problems. If you own offshore shares or property, chat to someone who knows something about situs tax to ensure that you have the right structures in place (like offshore life cover) to cover this liability. Alternatively, you can have your assets restructured to avoid this tax altogether.Probate: When you die, your executor will distribute your assets to your heirs in accordance with your will. If you own overseas assets, you will need to get permission to have your will and your executor recognised in the country concerned. This requires a grant of probate, which can be messy and costly. You can avoid this by having an overseas will to cover your overseas assets. This will ensure that the winding up of your local estate is not delayed unnecessarily by your offshore assets.So, to answer your question, it makes sense to move about half your assets offshore because you get to reduce the country concentration risk. Offshore equity was the top performer over five, 10 and 15 years.Be careful of the structures you use. You do not want the hassles of situs and probate. Rather use one of the offshore solutions designed for South African investors.There are companies in South Africa that can facilitate an offshore investment for you with a single premium as low as R100,000. If you want to invest monthly, you can invest in an offshore endowment for as little as R3,000 a month.If you use one of these solutions, you can avoid the situs and probate issues. These investments need never be brought back to South Africa, creating a nice offshore nest egg for your family. This is especially useful when distributing assets to children who are living in different parts of the world.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!