No. 225 – Restructure your assets sensibly to preserve the money for heirs

Question

I’m a widow with a terminal diagnosis. I want my two children, both in their 50s, to inherit with minimum cost and delay. I have R5 million in bank accounts, R7 million in unit trusts, R5 million in RSA Retail Savings Bonds, and a R5 million home. What should I do?

Answer

The kindest legacy you can leave is clarity. A tidy estate prevents the small frictions that can become big family problems during a very emotional time. I will run through a couple of the items you should look at.

Will

Update your will and name a professional executor you trust. Give them explicit authority to sell assets and sign transfer documents without further consents. If you want the house sold, say so plainly. If you want equal shares, say how that equality should be achieved. Avoid the temptation of having a family member act as executor – this often results in family disagreements over trivial items.

Complete a “Loved ones File” which lists every account, policy and investment, with numbers, contact people and email addresses. I have a template that you can use – just send me an email.

Write a brief letter of wishes. It is not binding, but it explains your “why” and softens edges. Families handle decisions better when they understand intent.

Sort your medical paperwork. An advance directive and the right consents can spare your children difficult choices. Ask your attorney to flag any capacity concerns now, because a normal power of attorney lapses if capacity is lost.

Attach beneficiaries where possible

If an asset has a beneficiary attached to it, the transfer is quick. Look at those assets where there is no beneficiary and see if you can move them into one where there is a beneficiary. The following investments don’t allow beneficiaries:

- Bank deposits

- Unit trusts

- Retail bonds

Transferring these assets to your heirs will take a while as they must be dealt with by your executor and will only be transferred when your estate has been finalised.

Where is makes sense, move these assets int structures where you can attach beneficiaries. These would include moving them into:

- Endowment policies

- Sinking funds

- Disallowed retirement annuities

I would recommend that you look at each asset through two lenses: speed and tax. Ask, “Can this pay outside the estate?” and “What tax would I trigger to make that happen?”

For example, look at your unit trust portfolio – left alone, it will trigger CGT and executor fees. If you move them into an endowment or sinking fund, you can eliminate executor fees and have the benefit paid to the beneficiary within weeks. However, it will crystallise CGT today. Given that the CGT would have to be paid when you pass away, this should not be a showstopper.

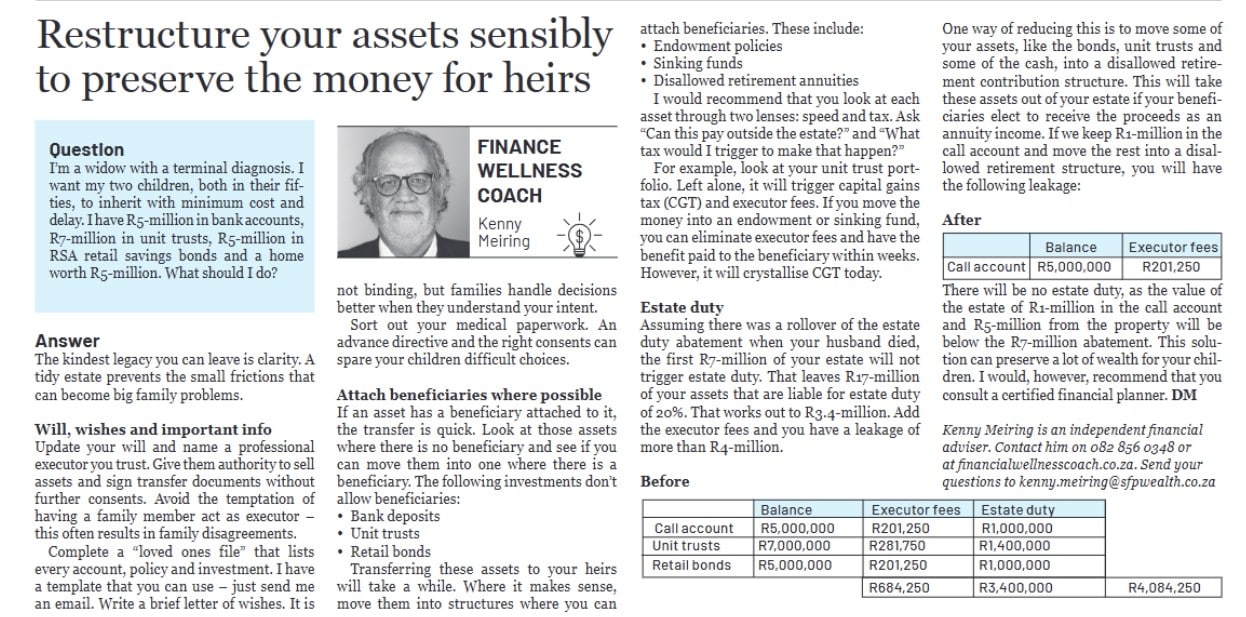

Estate duty

Assuming there was a rollover of the estate duty abatement when your husband passed away, the first R7m of your estate will not trigger estate duty. That leaves R17m of your assets that are liable for estate duty of 20%. This works out to R3.4m. Add in the executor fees and you have a leakage of over R4m

Before

|

|

Balance |

Executor fees |

Estate duty |

|

|

Call account |

R5,000,000 |

R201,250 |

R1,000,000 |

|

|

Unit trusts |

R7,000,000 |

R281,750 |

R1,400,000 |

|

|

Retail Bonds |

R5,000,000 |

R201,250 |

R1,000,000 |

|

|

R684,250 |

R3,400,000 |

R4,084,250 |

One way of reducing this is to move some of your assets like the bonds, unit trusts and some of the cash into a disallowed retirement contribution structure. This will take these assets out of your estate if your beneficiaries elect to receive the proceeds as an annuity income. Given that your children are approaching retirement age, this could be a very attractive option for them. They get to boost their retirement savings while saving estate duty and executor fees.

If we keep R1m in the call account and move the rest into a disallowed retirement structure, you will have the following leakage

After

|

|

Balance |

Executor fees |

|

Call account |

R1,000,000 |

R40,250 |

There will be no estate duty as the value of the estate of R1m in the call account and R5m from the property will be below the R7m abatement.

This solution can preserve a lot of wealth for your children. I would, however, recommend that you consult a certified financial planner as there are a number of moving parts and I do not know enough of yours and your family’s situation to give you a categorical answer.

A clear will, a simple Loved Ones File, and a few beneficiary updates will spare your children queues and confusion. Keep enough cash in the estate so things can be handled gently, and only shift investments when the tax picture makes sense. With a few thoughtful choices now, you can help your loved ones through a very difficult time.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!