No. 054 – Why income protection cover is a must-have

Question

I retired three years ago, with half my income coming from my company pension fund and the other half from interest from investments. I am paying tax at a rate of 41%. Is there anything that I can do to reduce this amount?

Answer

Income protection is an absolute must during your working years. In the past, this type of benefit was only available as part of your normal employee benefits arrangement at a large company. As the world of work evolved, the need for this type of benefit for employees at smaller companies, as well as those who are self-employed, resulted in products being designed to meet this need.

I recently saw some stats that said that 60% of self-employed people will end up in serious financial trouble if they are unable to work for more than three months. This risk can be removed by having income protection cover in place.

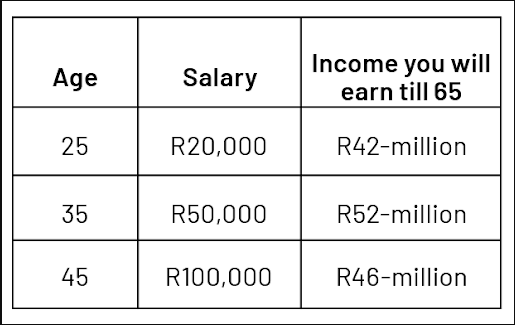

We often underestimate how much money we earn during our working lives. The table below gives an estimate of how much you will earn based on your age and salary. I have assumed that you only get 6.5% increases each year and that you never get promoted with a big salary increase. As you can see, the numbers are large.

A 35-year-old earning R50,000 a month will have earned about R52-million by the time she turns 65. If she had income protection and was unable to work because of illness or disability, the policy would pay her income with annual increases till she reached retirement age. This would ensure that she remained on the same financial trajectory that she was on before the illness and would not have to rely on government grants if the condition was permanent.

This is not the type of cover that you should try to put in place yourself, as there are so many moving parts that you need to manage. You do not want to find yourself in a position where you want to claim and then discover that you have the wrong cover.

There can be a massive difference in the prices of the various options, so it is important that you choose the most appropriate selection of options.

To ensure that you have a meaningful discussion with your broker, here are a few options that you should be aware of.

Waiting period

This is the time taken before the benefit starts to pay out. Waiting periods can range from seven days to two years. The longer the waiting period, the cheaper the cover will be. There is therefore a balancing act here between the costs of the premium and your need for income.

Definitions of disability

This is where a lot of problems arise at the claims stage, so it is important that you get your adviser to explain exactly how you would be covered. The usual definition of disability would be that you are unable to do your own or a similar job. The big question is what “similar” means and what “unable to do it” means.

Some companies also offer cover based on long lists of impairment conditions. What is nice about this is that you are paid out on diagnosis of the condition, and you do not have to prove that you are unable to work.

Reinstatement of cover

Does the cover reinstate after you have made a claim? If you had a heart attack and were off for a few months, would you still be covered if you had another heart attack in a year’s time and were booked off again?

Business overheads

In addition to your personal income, you may have business overheads such as salaries and rental that have to be paid. If you are the main income generator in the business, you need to ensure that both your personal income and business expenses are taken care of. This option is offered on many of the income protector products.

In South Africa you are nine times more likely to experience a situation where you are unable to work for an extended period of time than you are to be hijacked. It is much more important for you to insure your ability to earn an income than to insure your car.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!